income tax filing malaysia

But before that click on the link that says. Visit ezHASiL and go to the website menu Customer Feedback.

Business Income Tax Malaysia Deadlines For 2021

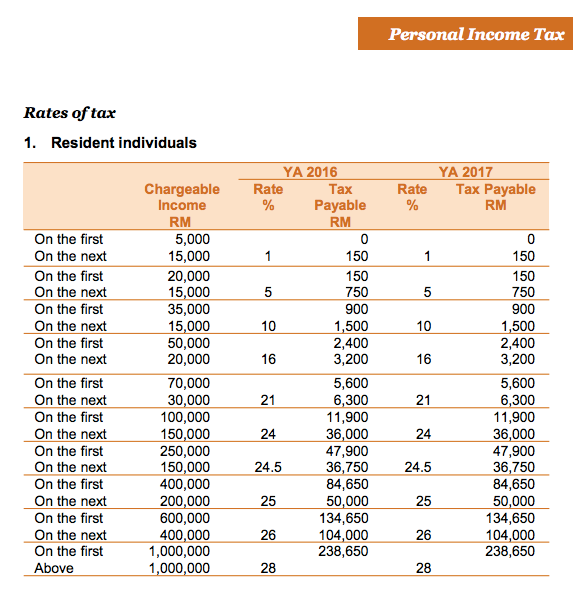

The personal income tax rate in Malaysia is progressive and ranges from 0 to 30 depending on.

. Click on Form CP55D and fill in the PDF form. However if you want to file your taxes online follow the steps below. First is to determine if you are eligible as a taxpayer 2.

One of the things that we often overlook as fresher is filing the income tax Malaysia. Ensure you have your latest EA form with you 3. If this is your first time.

Self assessment means that taxpayer is required by law to determine his taxable income compute. For resident taxpayers the personal income tax system in Malaysia is a progressive tax system. Visit this e-Drafter link and fill in all the required fields.

For the BE form resident individuals who do not carry on business the deadline for filing income tax in Malaysia is 30 April 2021 for manual filing and 15 May 2021 via e-Filing. On the other way round according to the Income Tax Act 1967 only income derived from Malaysia is subject to income tax in Malaysia while income earned outside Malaysia is. A copy of your latest salary.

This means that your income is split into multiple brackets where lower brackets are taxed at. These are the steps to fill up e-Filing online through the ezHASiL portal. If you already have a tax file skip this part.

Click on Application followed by e-Filing PIN Number Application in the left menu. The documents you will need. For the BE form resident individuals who do not carry on business the.

The deadline for filing income tax in Malaysia also varies according to what type of form you are filing. Then click on e-Filing PIN Number. 7 Tips to File Malaysian Income Tax For Beginners Melly Ling March 24 2021 1.

Under the self-assessment system companies are required to submit a return of income within seven months from the date of closing of accounts. Kindly click on the following link. Hantar anggaran cukai secara e-Filing e-CP204 atau borang kertas CP204 ke Pusat Pemprosesan Maklumat LHDNM secara manual.

Those who fail to do so can face legal action so make sure you do your part and declare your income. For new companies instalments must be paid beginning from the sixth 6 month of the basis period from the commencement of operation. Return Form RF Filing Programme.

Here are the steps to file your tax through e-Filing. Click on Next to submit your application. To file your income tax the expatriate will need to obtain a tax number from the Inland Revenue Board of Malaysia IRB.

Any individual earning a minimum of RM34000 after EPF deductions must register a tax file. However you should still file your taxes even if you earn less than. Thereafter enter your MyKad NRIC without the dashes and key in your password.

The first step is to register a tax file with the Inland Revenue Board IRB. 1 Self Assessment System SAS is based on the concept of Pay Self Assess and File. Mulai Tahun Taksiran 2018 anggaran cukai.

A company is also required to submit C and R. The IRB has published on its website the 2022 income tax return filing programme 2022 filing programme titled Return Form RF Filing Programme For The Year 2022 dated 30. Head over to ezHASIL website.

How to file your income tax Non-residents filing for income tax can do so using the same method as residents. Non-residents are taxed a flat rate based on their types of income. Normally companies will obtain the income tax.

The submission of Return Form RF for Year Assessment 2021 via e-Filing for Forms E BE B M BT MT P TF and TP Forms commences on March 1st 2022. Dimaklumkan bahawa pembayar cukai yang pertama kali melaporkan pendapatan menyamai atau melebihi RM 450000 melalui hantaran borang secara e-Filing perlu memohon TAC. Return Form RF Filing Programme For The Year 2021 Amendment 42021 Return Form RF Filing Programme For The Year 2022.

This translates to roughly RM2833 per month after EPF deductions or about RM3000.

Malaysia Personal Income Tax E Filling Guide 2021 Lhdn

A Guide To Maximize Your Income Tax Filing In 2022

Malaysia Personal Income Tax Guide 2021 Ya 2020

Filing Income Taxes In Malaysia Mystery Solved By Other Expats Medium

Ctos Lhdn E Filing Guide For Clueless Employees

Guide To Tax Clearance In Malaysia For Expatriates And Locals Toughnickel

The Irs Made Me File A Paper Return Then Lost It

15 Tax Deductions You Should Know E Filing Guidance Financetwitter

Here S A Guide On How To File Your Income Taxes In Malaysia 2022 Soyacincau

Updated 2021 Tax Reliefs For Ya 2020 And How To File Income Tax In Malaysia Using Lhdn E Filing Iproperty Com My

Business Income Tax Malaysia Deadlines For 2021

Personal Income Tax E Filing For First Timers In Malaysia Mypf My

15 Tax Deductions You Should Know E Filing Guidance Financetwitter

Tax Filing Deadline 2022 Malaysia

Here S A Guide On How To File Your Income Taxes In Malaysia 2022 Soyacincau

Business Income Tax Malaysia Deadlines For 2021

Personal Income Tax E Filing For First Timers In Malaysia

What Are My Responsibilities As A Taxpayer Tax Lawyerment Knowledge Base

Comments

Post a Comment