income tax bracket malaysia

Malaysia Residents Income Tax Tables in 2022. Top 20 T20 Middle 40 M40 and Bottom 40 B40.

Individual Income Tax In Malaysia For Expats Gpa

An approved individual under the Returning Expert Programme who is a resident is taxed at the rate of 15 for 5 consecutive YAs.

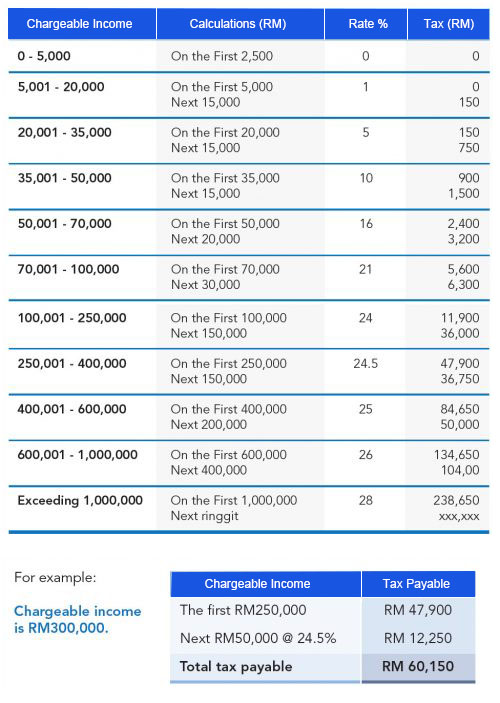

. The standard corporate income tax rate in Malaysia is 24 for both resident and non-resident companies which gain income within Malaysia. Chargeable Income Calculations RM Rate TaxRM 0 2500. However there are exceptions for certain.

Personal Income Tax. However if you claimed RM13500 in tax deductions and tax reliefs your chargeable. It is applicable to all tax residents.

This booklet also incorporates in coloured italics the 2023. 13 rows Malaysia Residents Income Tax Tables in 2020. Calculations RM Rate TaxRM 0 - 5000.

Up to RM4000 for those who contribute to the Employees Provident Fund EPF including freelance and part time workers. Income Tax Rates and Thresholds Annual Tax Rate Taxable Income Threshold. 13 rows 28.

Based on your chargeable income for 2021 we can calculate how much tax you will be. A non-citizen receiving a monthly salary of not less than. An effective petroleum income tax rate of 25 applies on income from.

Income tax bracket malaysia Friday October 14 2022 Add Comment Edit. On first RM600000 chargeable income 17 On subsequent chargeable income 24 Resident company with paid-up capital above RM25 million at the beginning of the basis period 24. Any individual present in Malaysia for at least 182 days in a.

On the First 5000 Next 15000. Starting from 0 the tax rate in Malaysia goes up to 30 for the highest income band. Petroleum income tax is imposed at the rate of 38 on income from petroleum operations in Malaysia.

Based on this amount the income tax to pay the government is RM1640 at a rate of 8. On the First 20000 Next. On the First 5000.

However if you claimed RM13500 in tax deductions and tax reliefs your chargeable income will be reduced to RM34500. Malaysia has a progressive scheme for personal income tax. FYI every household in Malaysia will be grouped in B40 M40 or T20 depending on their monthly income.

Income Tax Rates and Thresholds Annual Tax Rate Taxable Income Threshold. Malaysia adopts a territorial approach to income tax. KUALA LUMPUR Malaysians will see a tax cut of 2 percentage points for those in the RM50001-RM70000 and RM70001-RM100000 taxable income brackets.

On the First 2500. This enables you to drop down a tax bracket lower your. A qualified person defined who is a knowledge worker residing in Iskandar Malaysia is taxed at the rate of 15 on income from an.

As of writing the Malaysian. RM9000 for individuals. This publication is a quick reference guide outlining Malaysian tax information which is based on taxation laws and current practices.

Chargeable income RM20000 Total tax amount RM150 Chargeable income less than RM35000 can get a RM 400 tax rebate so Ali does not need to pay any tax amount to. This booklet also incorporates in coloured italics the 2023. This is based on the.

As a general rule anyone earning a salary in Malaysia is required to pay income tax unless they fall into one of the. Last updated 24 March 2022 Malaysians are categorised into three different income groups. Information on Malaysian Income Tax Rates.

This is so that the gahmen can monitor create a financial. A non-resident individual is taxed at a flat rate of 30 on total taxable income. Up to RM3000 for.

The State Of The Nation Finding Room To Lighten The Middle Income Tax Burden The Edge Markets

Understanding Tax Smeinfo Portal

Malaysia Personal Income Tax Rates Table 2010 Tax Updates Budget Business News

Irs Announces 2014 Tax Brackets Standard Deduction Amounts And More

Abss Payroll V11 What S New Abss Accounting Malaysia

Corporate Tax Rates Around The World Tax Foundation

Malaysia Personal Income Tax Rates 2013 Tax Updates Budget Business News

How To Calculate Income Tax In Excel

Borang Tp 1 Tax Release Form Dna Hr Capital Sdn Bhd

Here S A Guide On How To File Your Income Taxes In Malaysia 2022 Soyacincau

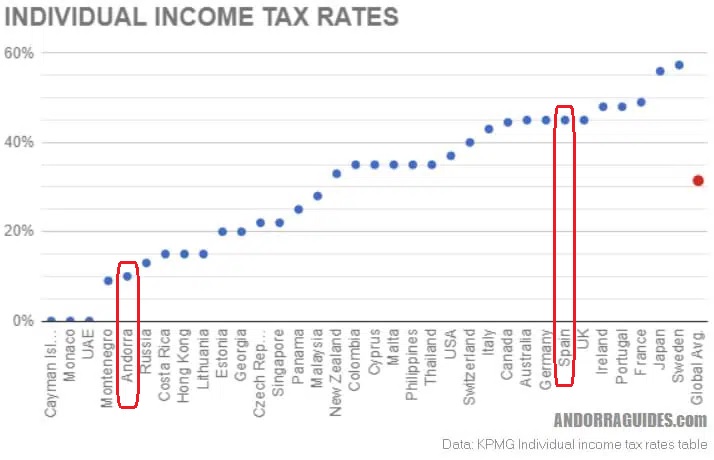

Learning From Andorra S Tax System International Liberty

Income Tax Challenges And Smart Planning For Irrevocable Trusts 1

Taxing High Incomes A Comparison Of 41 Countries Tax Foundation

Individual Income Tax In Malaysia For Expatriates

The State Of The Nation Finding Room To Lighten The Middle Income Tax Burden The Edge Markets

Denmark Personal Income Tax Rate 2022 Data 2023 Forecast 1995 2021 Historical

Income Tax Rate Comparison Between Malaysian Singaporean R Malaysia

Comments

Post a Comment